Avail The CitiBank Checking Account $600 Cash Bonus

Citibank has its headquarter is in New York and was founded in 1812, and. It’s the consumer division of the multinational Citigroup. The bank provides all kinds of loans, mortgages, credit cards and so on.

The bank consists of 3 different consumer checking and savings account promotions that provide a $600 bonus which has to have a $50,000 deposit into a Citi Priority Account Package, a $400 bonus which has to have a $15,000 deposit into the Citibank Account Package, or you can always check the $200 bonus which must have a $5,000 deposit into the Basic Banking Package. In this case, you have to maintain the deposits for at least 60 days if you want to qualify for the cash rewards.

Citi Basic Banking Package

There is a $200 bonus you will receive when you open a new checking account and savings account in the. This promotional offer you can get until September 30, 2019. Basic Banking Package and you have to make a deposit of $5,000 for at least 60 days.

Citibank Priority Account Package

This $600 bonus you will get when you open a savings and a checking account in the Citibank Priority Account Package and it has to be a new one. This very lucrative offer is available until September 30, 2019. Also, you have to make a deposit of $50,000 for at least 60 days.

Citibank Account Package

You will get a $400 bonus only if you open a new checking account and savings account in the Citibank Account Package and you have to make a deposit of $15,000 for at least 60 days. This amazing offer is available until September 30, 2019.

You can always apply online for the checking accounts, in-branch, or by phone for these checking account offers of Citibank.

$600 Citibank Priority Account Package Bonus features

-

You have to open a new checking account and savings account in the Citibank Priority Account Package and it has to be by September 30, 2019.

-

You have to make an eligible deposit of $50,000 or over in your new checking or savings account within 30 days after you get to open the account,

-

You have to visit Citibank Priority Account Package $600 Promo Page to apply online. For this, you need to visit a Citibank branch to apply in person or call CitiPhone Banking to apply by phone

-

The $600 cash bonus will be credited to your new checking account of Citibank within 90 days until you finish all offer requirements.

-

You also have to maintain a minimum balance of $50,000 for 60 days

Citibank $600 Checking details on the promotion

-

The offer takers can have an existing Citibank Savings Plus Account with CitiBank.

-

There is s limit of 1 of each offer per customer and 1 offer per account.

-

For the Citibank Priority Account Package, a new checking account is required.

-

You need to have a savings account in The Citibank Priority Account Package

-

Signers on fiduciary, estate, business, and certain trust accounts are eligible for the offer.

-

For this part you must pay a monthly service fee of $30 applies to the checking account in The Citibank is the Priority Account Package and a $2.50 non-Citibank ATM withdrawal fee requirements that are not fulfilled.

Eligibility for the $600 checking bonus

-

If you want to qualify for this promotion, you have to enroll in the promotion, agree to the terms and conditions of this offer and you also have to perform the required qualifying activities included in this offer.

-

If you want to take part in this promotion, you must not have a consumer checking account with Citibank or have been a signer on or owner of a Citibank checking the account for consumers at least not within the last 180 days.

-

If you are a consumer you must be 18 years or older to participate in this Citibank promotion.

-

All the existing checking customers are not eligible.

-

The enrollment in this very offer does not guarantee eligibility.

Apply for the Priority checking account of Citi

For this, you have to venture to, www.banking.citi.com/cbol/checking-600

-

On the main page, at the middle right side, click on the, ‘Apply now’ button in navy blue.

-

If you want to receive an interest, you have to choose the account type,

-

Regular checking

-

Interest checking

-

For the first, you will be taken to a new tab.

Here, at the middle left side of the page, you will get the blanks, and you have to type,

-

First Name

-

Middle Initial (optional)

-

Last Name

-

Email Address

-

Primary Phone Number

-

Address

-

Unit No. (optional)

-

Citizenship

-

Date of Birth

-

Social Security Number

-

Specify if you plan on using this account to send or receive money internationally?

-

Mother’s Maiden Name

-

Name of your Elementary School

-

Specify if you would like to add a joint applicant? (optional)

-

If you’d like to add one later, you can do so at visiting any Citibank branch, or you can call on, 1-800-321-CITI.

-

Specify the tax Certification

-

Agree to the information

-

Agree to the account disclosure and terms

-

Then, click on, ‘Next’ in blue.

You have to follow the prompts after this and you will be able to apply for the checking account.

For interest checking, you will be taken to a new tab, and here, you have to fill up the same information as a regular checking.

The benefits of the Priority checking account

-

You will get fee-free access to cash at over 60,000 ATMs across the country.

-

The Citi Mobile App will give you the link to non-Citi accounts, deposit checks on-the-go, track spending habits, and how to easily find nearby ATMs.

If you want to get enhanced benefits from the Citibank, then, you have to register and log in to the online account for it.

Register with Citibank account

To register you need to venture to, www.banking.citi.com/cbol/checking-600

-

Here on the landing page, you need to scroll down to the bottom, and there you will get at the left side the logo of Citibank, you have to click on, it and you will be taken to the Citibank main page.

-

In this page at the right side, you will get the log in box. Here at the bottom right side of the box click on, ‘Register for online access’.

Here at the left side, you have to choose how you want to register for the account.

-

Credit or debit card number

Or

-

Bank account number

For the first, you need to type,

-

Card Number

For the second, type,

-

The bank account number

-

Then at the bottom right side press on, ‘Continue set up’.

Do follow the prompts after that, and you will be able to register.

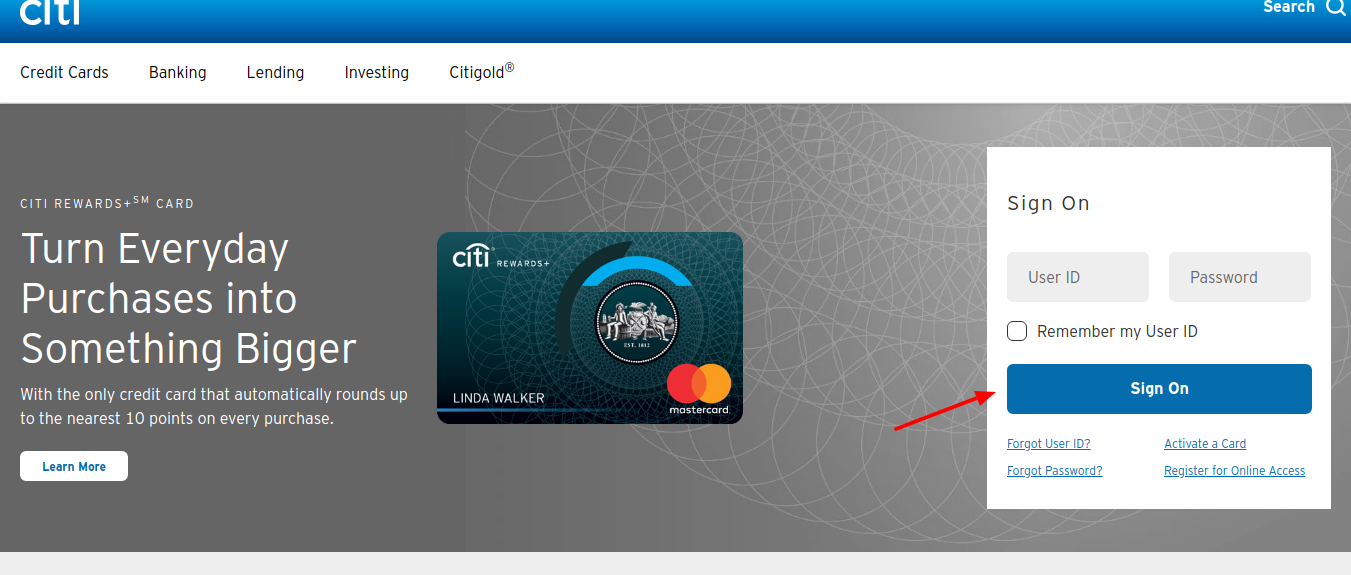

Logging in to the Citibank account

To log in you need to type this link in the browser, www.banking.citi.com/cbol/checking-600

Here on the landing page, you need to scroll down to the bottom, and there you will get at the left side the logo of Citibank, you have to click on, it and you will be taken to the Citibank main page.

In this page at the right side, you will get the log in box. Here you have to enter the

-

User ID and

-

The confirmed password

Then at the middle side of the box, click on, ‘Sign on’.

Forgot username or password details

If you have forgotten the login credentials of, Citibank, then here you need to go to the same page login box, here, under the login blanks at the left side you will get the option for, ‘Forgot user ID’.

On the next page at the left side type,

-

ATM or debit card Number

-

After typing this you have to click on, ‘Continue’.

For the password, go at the right side option, ‘Forgot password’.

Here also you have to enter,

-

ATM or debit card Number

-

After typing this you have to click on, ‘Continue’.

Do follow the later prompts and you will be able to get the password.

Benefits of the online account

-

Get to pay the bill

-

Get special offers

-

Get to activate alerts

-

You will get to track account activity

Waiving the Citibank monthly banking fees

To waive it, you have to maintain a substantial minimum balance in the Citigold and Citibank accounts only if you want to avoid paying monthly maintenance fees.

Citigold Account Package

The monthly service fee of Citibank you can waive only if you go on maintaining a combined average monthly balance of $50,00. It has to be a combination of deposits and retirement balances or of monthly balances in deposits, retirement, investments, credit cards, and loans. If this is not met, you will be charged a $30 monthly service fee. In this case, if you do not maintain a minimum combined average monthly balance of $200,000 in the eligible deposits of Citibank, investment balances and retirement accounts, your applied Citigold Account Package will be converted to a different banking package.

Citi Priority Account Package

For this, a $30 monthly service fee will be applied to the checking account in The Citi Priority Account Package. This will happen if a minimum combined average monthly balances are not completed. Apart from this in the first 2 months after opening your new Citi Priority account or if you are converting to Citi Priority, you will be charged by Citibank a $30 monthly statement fee, and will be applied if you do not maintain the needed $50,0000.

Also Read : Grab The TD Bank Checking Bonuses Account Offer

Basic Banking Package

The monthly fee will not be applied only if you keep a perfect combined average monthly balance of $1,500 in the Citibank account and this can be either your Basic checking or your linked Basic Savings Account. If you fail to do this, there will be a $10 monthly service fee. Here, you must know that, transfer payments made to accounts within Citibank or to accounts with Citibank affiliates. these do not qualify as bill payments for this offer.

Citibank Account Package

You will not have to pay the service fee monthly only if you maintain a combined average monthly balance of $10,000 in specifically for, eligible linked products, on the reverse you have to pay a monthly service fee of $25. The eligible linked products are linked deposits, loans, mortgages, credit cards, investment, and retirement accounts.

Contact details

If you are facing some problems, or have some queries with the Citibank, you need to call on, 1-888-248-1636 or to, 1-800-374-9700. Or you can send a mail to, PO Box 6500, Sioux Falls, SD 57117.

Reference :

www.banking.citi.com/cbol/checking-600