Earn an Amazing Amount of Rewards with Priceline Rewards Visa Card:

If you are a frequent traveler and committed to the Priceline, then you can definitely go for the Priceline Rewards Visa Card issued by Barclays. This card offers good rewards for the ones and also you get a bonus on making your first purchase, as well the points you will earn will have several ways to be redeemed. So, let’s take a look at the features of the card and also the activation procedure, and all the other aspect required for the card.

Benefits of Priceline Rewards Visa Card:

- When you are spending $1 on any travel purchase, you will get a reward of 5 points, and the interesting thing is each point worth 1.5 cents, which means you will get 7.5 cents when you are spending $1 which is an amazing deal if compared to many other cards.

- You will get flexible redemption options for travel.

- This card comer with 0% APR offer.

- During the balance transfer, this card offers you no fee scheme during the first 15 months, then you need to pay a fee of $5 or 5% of the total balance being transferred, but at the same time you are given rewards on balance transfer, making the system much less costlier.

- When you make foreign transactions with this card, you don’t need to give any fee.

- This card comes with zero fraud liability, which means you are protected from any fraudulent activities if your card get stolen or misplaced.

- You will receive a bonus of $150 on your first purchase which is good opportunity for many travelers.

If you want to enjoy these benefits, then you need to make sure of a few things, you have to be a frequent traveler, you must have an excellent score to apply for the credit card and when it is mentioned so that means that you need to have a score above 720, and you have to commit to the priceline.com and make sure you also make Priceline purchases of certain types.

It is better to check your credit score before applying, since if you apply to give all your data that might lower your score if you don’t get approved.

Other features of the card:

- This card comes with a regular APR of 15.99%-25.99% which is variable.

- You will be best rewarded when you are immediately paying the site for the transaction, but if you are using the site to pay later, then you will receive a default reward of 1 point on spending $1.

- This card gives you an offer having 10,000 bonus points, but for that, you need to spend $1000 within the first 90 days.

- If you have not made any purchase within six months, then your account will be shut down and any unredeemed reward will be gone with it, so be careful.

Who are ones needing this card:

The card is best for the ones who travel through priceline.com and are making purchases from their site. This is also good for the ones who are looking for balance transfer that comes with 15 months no fee offer.

How will you redeem your rewards:

There are several redemption options that you can follow –

- If you redeem the points for a statement credit against the same purchases that are eligible for bonus points, then your points will worth 1.5 cents as mentioned earlier. For that to occur you need to make a purchase of $25 or above.

- If you make purchases below $25, then your points will receive 1 cent per point on statement credit.

- If you think of redeeming the points with gift cards, then you will receive 0.83 cents per points that starts with $25 gift card for 3000 points.

- If you are going for the merchandise then the value of the points might decrease

- If you are redeeming your points for travel and eligible Priceline purchases, then you are supposed to get 10% of your points back. The only factor you need to keep in mind is that you will receive 1.65 cents per point with Priceline statement credit and 1.1 cents per point on other travel statement credit.

If you have already got the card in your hands, then you must also activate it.

Activation procedure of the Priceline Rewards Visa card:

- You have to go to the activation site of the Priceline Rewards Visa Card or you can follow the link pricelinerewardsvisa.com.

- Then you have to click on the Cardmember Login.

- Then on the next page, you have to click on the Click here to set up online access.

- Then on the next page, you are directed you need to give credentials for the verification. The credentials include – the last 4 digits of Social Security Number, Date of Birth, Account Number, Current Occupation, and lastly select whether you are a citizen of the United States or not, and then click on the Continue button.

- After your details are verified, your card will be successfully activated.

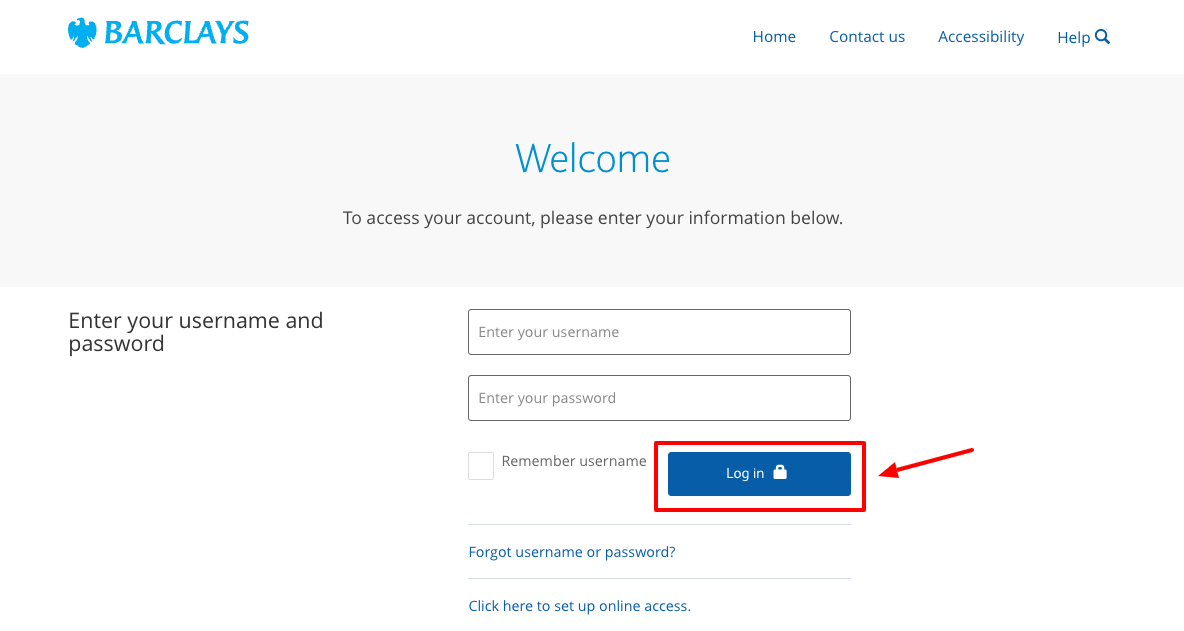

For the logging in procedure to get Access to your Account, follow the steps:

- First you need to go to the Barclays Priceline Visa Credit Card page, using the link pricelinerewardsvisa.com.

- Then you have to click on the Cardmember Login.

- Then on the next page, you have to give your Username and Password.

- Then click on the Login button and you will have the access to your account.

Also Read: How to Activate Marriott Bonvoy Boundless Credit Card Online

You will also be able to activate your Credit Card by making a call on the number 877-408-8866 and you have to follow the prompts to complete the activation procedure.

Now we will get into the payment procedure of the Priceline Rewards Visa Card:

There are numerous ways in which you can make the payment of your credit card bills as given below –

- Online mode – if you are opting to make an online payment, then you have to first login to your account, then you have to select the option Make a Payment from the payment menu, and then you have to choose the type of payment.

You can also provide your bank information so that you can make a direct debit from your account. The payment can be set in the automatic mode where the monthly bill will be deducted each month on the same date.

- Through phone – you can also pay your bills phone by making a call on the number 1-302-622-8990 and then you can get to speak with a customer representative and make your bill payments.

- Through Mail – you can also pay through mail, where you have to send a check or money order and need to mention the account number on the check-in the given address –

Card Services

P.O. Box 60517

City of Industry, CA 91716-0517

OR

Card Services

P.O. Box 13337

Philadelphia, PA 19101-3337

You have to send the mail before the due date of the billing, since the processing takes time. So try sending the mail prior 5 days earlier so that you won’t be charged with any late fee.

For the overnight Credit Card payments, you have to send the mail in the following address – you have to use specific labels and envelopes through UPS, Mail Boxes etc., FedEx, U.S. Mail (to be applied for both the mailing address)

Remco

Card Services

Lock Box 65017

2525 Corporate Place, Suite 250

Monterey Park, CA 91754

OR

Card Services

400 White Clay Center Drive

Newark, DE 19711

Conclusions:

This article provides you with all the possible ways required for the activation of your Priceline Rewards Visa Card as well the payment options that are available for the credit card. While going through the article, if you face any problem, then you can always contact them on the number 1-866-225-9725 or you can also send them a mail on the address –

Card Services

P.O. Box 8801

Wilmington, DE 19899-8801

If you need to make any general inquiries, then you can call on the number 866-951-1440.

For the credit card billing dispute, then you have to send a mail on the address –

Card Services

P.O. Box 8802

Wilmington, DE 19899-8802

Reference:

pricelinerewardsvisa.com/activate