In case you’re hoping to get a business Visa and your credit is simply reasonable, you’re won’t meet all requirements for a great deal of the extravagant accessories that accompany the absolute best private venture charge cards. The Capital One Spark Classic Card may not accompany a lot of additional items like a welcome reward or early on 0% APR offer.

There are certainly not a ton of decisions accessible to somebody without heavenly credit looking for a business charge card. Besides procuring rewards and a more lenient endorsing strategy, the Capital One Spark Card additionally accompanies some pleasant advantages like maintenance agreement.

Features of Capital One Spark Business Card:

- Bring in limitless 1% money back for your business on each buy, all over the place, with no restrictions or classification limitations

- No yearly charge

- Construct and fortify credit for your business by utilizing this MasterCard capably

- $0 Fraud Liability if your card is lost or taken

- Free representative cards, which additionally bring in limitless 1% money back on all buys

- Prizes will not lapse for the existence of the record, and you can recover your money back for any sum

Rates of Capital One Spark Business Card:

- APR on Purchases is 26.99%

- Annual Fee is $0

- Cash Advance is 3% of the amount of the cash advance, but not less than $10

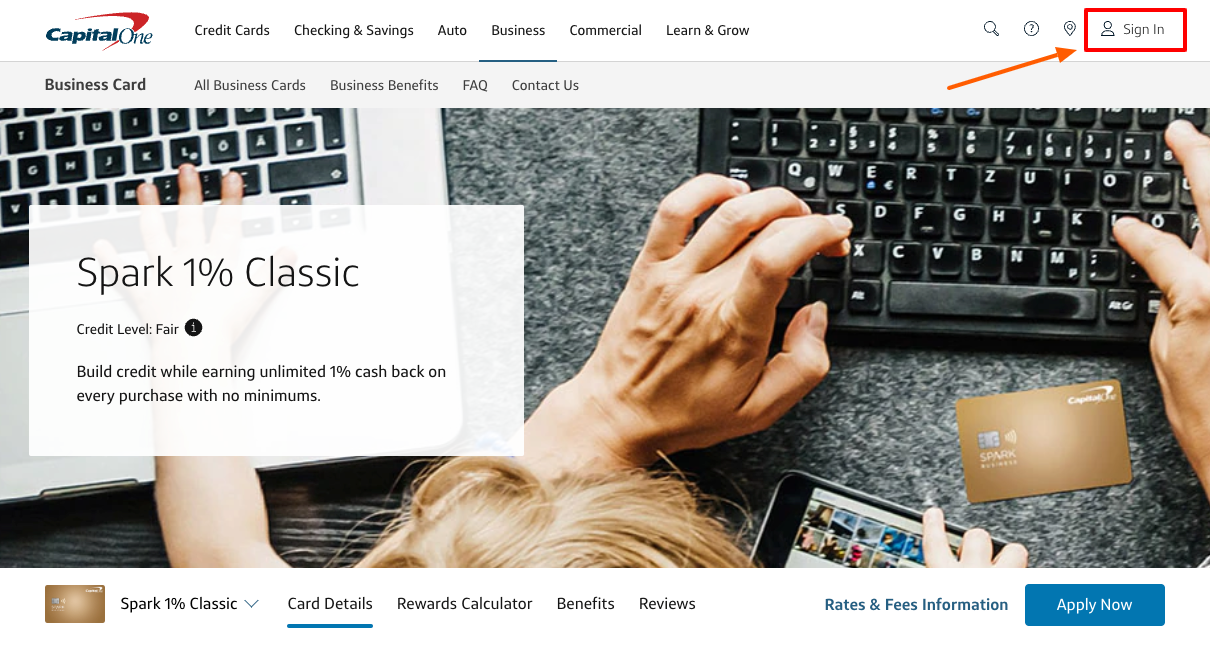

Capital One Spark Business Card Login:

- Copy and paste the URL www.capitalone.com/small-business/credit-cards/spark-classic in the address bar

- Click on ‘Sign in’ button at top right section of the page.

- Enter the username, password click on ‘Sign in’ button.

- You can pay the bill online after logging in to the online account.

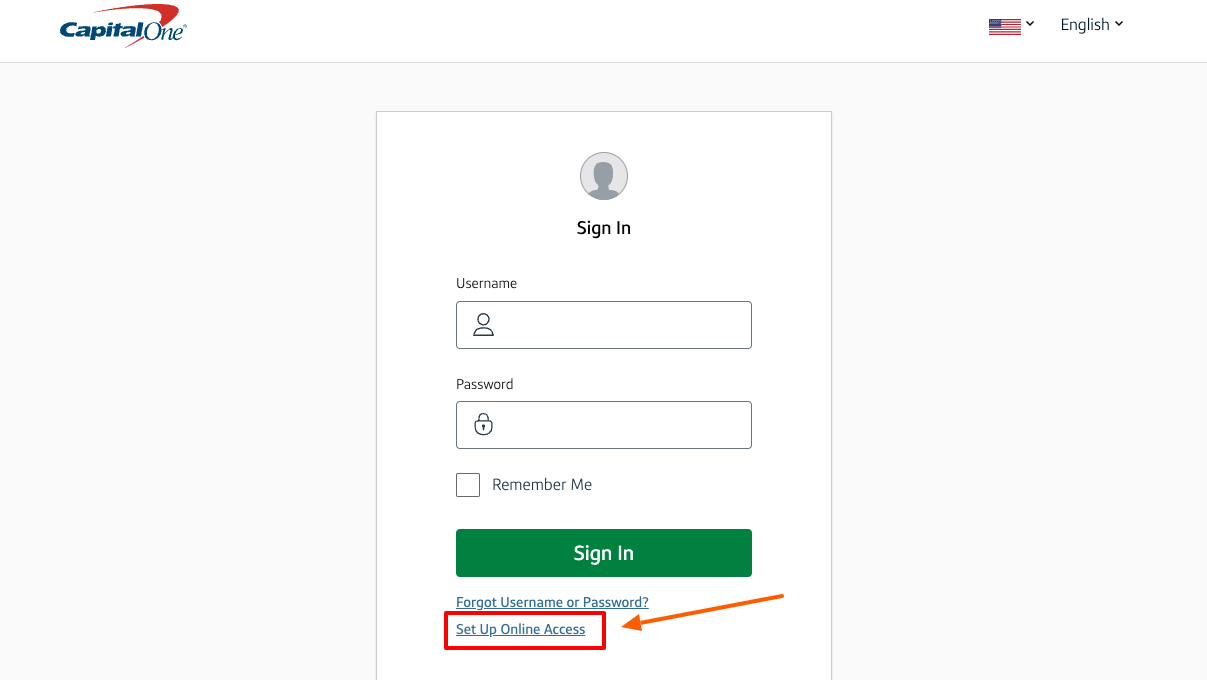

Recover Capital One Spark Business Card Login Initials:

- Go to the Capital One Spark Business Card portal home page. The URL for the website is www.capitalone.com/small-business/credit-cards/spark-classic

- Hit on ‘Forgot username or password?’ button under the login boxes.

- Add your name, SSN, date of birth now click on ‘Find me’ button.

Sign Up for Capital One Spark Business Card Account:

- Go to the website www.capitalone.com/small-business/credit-cards/spark-classic visit the card login.

- Now click on ‘Set up online access’ button.

- Provide your name, SSN, date of birth. Hit on ‘Find me’ button.

Activate Capital One Spark Business Card:

- Visit the official website of the Capital One Spark Business Card. The URL for the webpage is www.capitalone.com/small-business/credit-cards/spark-classic

- Login with the required information.

- After logging in you can utilize the credit card at eligible places.

Apply for Capital One Spark Business Card:

- To apply for the credit card visit the official web address www.capitalone.com/small-business/credit-cards/spark-classic

- At the center right section of the page click on ‘Apply now’ button.

- Next add the contact information.

- Now click on ‘Continue’ tab at the bottom of the page.

Also Read:

How to Manage your Capital One Savor Card Online

How to Activate Marriott Bonvoy Boundless Credit Card Online

Login to your Belk Rewards Credit Card Account

Important Things to Know About the Capital One Sparks Business Card

- The Sparks Business card from Capital One has no yearly expense for the principal year of purpose, yet has a $59 yearly charge for every year later

- There is no unfamiliar exchange expense for Capital One’s Spark card

- Clients who utilize their Capital One Spark card regularly can partake in a money back remunerations program

- When a Sparks cardholder burns through $4,500 on buys inside the initial 3 months of endorsement, the record will get $500 cash reward.

Advantages and Downsides of Capital One Business Spark Card:

- Biggest Advantages of the Capital One Business Spark Card: Users can decide to get their Capital One Spark Rewards consequently through really take a look at consistently (the choice the vast majority use), or they can bring in and demand a prizes payout whenever they have a prizes total of augmentations of $25, $50, $75, or $100.

- Downsides to the Spark Capital One Card: There are a few negative sides to the Capital One Spark card, be that as it may. It doesn’t have an extremely lengthy basic period with 0% interest, so in the event that a field-tested strategies on conveying an equilibrium at first on their card, they may be most attractive elsewhere.

Capital One Spark Business Card Bill Pay Through Phone:

- Pay the bill through toll-free phone number.

- Call on, (800) 227-4825. Then follow the automated instructions.

Capital One Spark Business Card Bill Pay by Mail:

- Pay the mail you can send the payment through money order or check

- Send the payment to, P.O. Box 60501, City of Industry, CA 91716-0501.

- The overnight address: Card Services Inc., ATTN: Exception Dept2012 Corporate Lane, Suite 108, Naperville, IL 60563.

Capital One Spark Business Card Bill Pay in Person:

- The bill is payable at MoneyGram and Western Union places.

- Carry your payment details with you and make the payment.

- This might require a fee.

Frequently Asked Questions on Capital One Spark Business Card:

- Is The Capital One Spark Card Good?

Capital One Spark Cash for Business has truly outstanding and least complex business rewards charge card programs, with a huge sign-up reward and superb acquiring plan. While it has a yearly charge, it is deferred for the principal year, along these lines bringing down the gamble of evaluating the card for a primer period.

- What Is A Capital One Spark Card?

Capital One Spark is Capital One’s line of independent company charge cards. Four are intended for entrepreneurs with astounding credit, with a fifth intended for individuals with fair or normal credit.

Capital One Spark Business Card Contact Number:

For more information call on the toll-free number 1-800-867-0904.

Reference Link:

www.capitalone.com/small-business/credit-cards/spark-classic